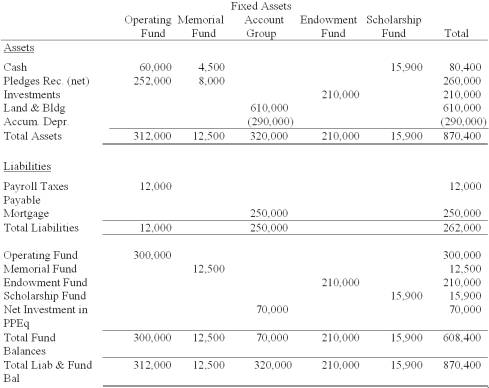

Union Seminary uses the fund basis of accounting for internal record keeping.Presented below is the fully adjusted 12/31/2012 balance sheet for Union,prepared using funds and account groups.The following are fund descriptions:

● Operating Fund - the fund used for transactions not falling within the definition of other funds.There are no restrictions on these resources.

● Memorial Fund - Used to account for resources donated from outside parties for specific capital additions.

● Endowment Fund - Assets received from an outside donor for permanent investment,only the earnings may be expended.

● Scholarship Fund - Cash set aside by the Seminary's governing board for use as scholarships and student aid.

● Fixed Assets Account Group - A record of the Seminary's fixed assets and long-term debt.

Required:

Prepare a Statement of Financial Position following the guidelines provided in FASB Statements 116 and 117 for private not-for-profits and assuming Union does not classify plant assets as temporarily restricted.

Correct Answer:

Verified

Q101: With respect to private colleges and universities,why

Q103: Identify three types of restrictions placed on

Q109: What is the basis of accounting for

Q119: Public colleges and universities are subject to

Q120: How should the income earned by a

Q122: Ballard University,a private not-for-profit,billed four students for

Q124: On January 1,2012,Antioch College,a private not-for-profit college,received

Q125: What accounts appear in the equity section

Q126: Record the following transactions on the books

Q127: Ethan Allen University is a private university

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents