Case Study Short Essay Examination Questions

Panda Ethanol Goes Public in a Shell Corporation

In early 2007, Panda Ethanol, owner of ethanol plants in west Texas, decided to explore the possibility of taking its ethanol production business public to take advantage of the high valuations placed on ethanol-related companies in the public market at that time. The firm was confronted with the choice of taking the company public through an initial public offering or by combining with a publicly traded shell corporation through a reverse merger.

After enlisting the services of a local investment banker, Grove Street Investors, Panda chose to "go public" through a reverse merger. This process entailed finding a shell corporation with relatively few shareholders who were interested in selling their stock. The investment banker identified Cirracor Inc. as a potential merger partner. Cirracor was formed on October 12, 2001, to provide website development services and was traded on the over-the-counter bulletin board market . Given the poor financial condition of Cirracor, the firm's shareholders were interested in either selling their shares for cash or owning even a relatively small portion of a financially viable company to recover their initial investments in Cirracor. Acting on behalf of Panda, Grove Street formed a limited liability company, called Grove Panda, and purchased 2.73 million Cirracor common shares, or 78 percent of the company, for about $475,000.

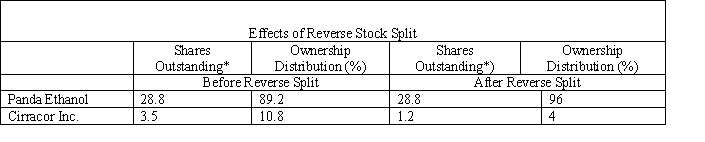

The merger proposal provided for one share of Cirracor common stock to be exchanged for each share of Panda Ethanol common outstanding stock and for Cirracor shareholders to own 4 percent of the newly issued and outstanding common stock of the surviving company. Panda Ethanol shareholders would own the remaining 96 percent. At the end of 2005, Panda had 13.8 million shares outstanding. On June 7, 2007, the merger agreement was amended to permit Panda Ethanol to issue 15 million new shares through a private placement to raise $90 million. This brought the total Panda shares outstanding to 28.8 million. Cirracor common shares outstanding at that time totaled 3.5 million. However, to achieve the agreed-on ownership distribution, the number of Cirracor shares outstanding had to be reduced. This would be accomplished by an approximate three-for-one reverse stock split immediately prior to the completion of the reverse merger (i.e., each Cirracor common share would be converted into 0.340885 shares of Cirracor common stock). As a consequence of the merger, the previous shareholders of Panda Ethanol were issued 28.8 million new shares of Cirracor common stock. The combined firm now has 30 million shares outstanding, with the Cirracor shareholders owning 1.2 million shares. The following table illustrates the effect of the reverse stock split.  * In millions of dollars.

* In millions of dollars.

A special Cirracor shareholders' meeting was required by Nevada law (i.e., the state in which Cirracor was incorporated) in view of the substantial number of new shares that were to be issued as a result of the merger. The proxy statement filed with the Securities and Exchange Commission and distributed to Cirracor shareholders indicated that Grove Panda, a 78 percent owner of Cirracor common stock, had already indicated that it would vote its shares for the merger and the reverse stock split. Since Cirracor's articles of incorporation required only a simple majority to approve such matters, it was evident to all that approval was imminent.

On November 7, 2007, Panda completed its merger with Cirracor Inc. As a result of the merger, all shares of Panda Ethanol common stock (other than Panda Ethanol shareholders who had executed their dissenters' rights under Delaware law) would cease to have any rights as a shareholder except the right to receive one share of Cirracor common stock per share of Panda Ethanol common. Panda Ethanol shareholders choosing to exercise their right to dissent would receive a cash payment for the fair value of their stock on the day immediately before closing. Cirracor shareholders had similar dissenting rights under Nevada law. While Cirracor is the surviving corporation, Panda is viewed for accounting purposes as the acquirer. Accordingly, the financial statements shown for the surviving corporation are those of Panda Ethanol.

:

-Who were Panda Ethanol,Grove Street Investors,Grove Panda,and Cirracor? What were their roles in the case study? Be specific.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: Case Study Short Essay Examination Questions

Cantel Medical

Q90: Case Study Short Essay Examination Questions

Cantel Medical

Q91: . Case Study Short Essay Examination Questions

Deb

Q92: Case Study Short Essay Examination Questions

GHS Helps

Q93: Case Study Short Essay Examination Questions

Panda Ethanol

Q94: . Case Study Short Essay Examination Questions

Deb

Q95: Case Study Short Essay Examination Questions

Cantel Medical

Q122: Deb Ltd. Seeks an Exit Strategy

In late

Q123: Valuing a Privately Held Company

Background

BigCo is interested

Q124: Valuing a Privately Held Company

Background

BigCo is interested

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents