Table 4.1

Bacon Signs

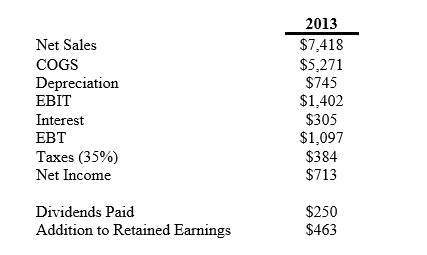

2013 Income Statement (000's)

Bacon Signs

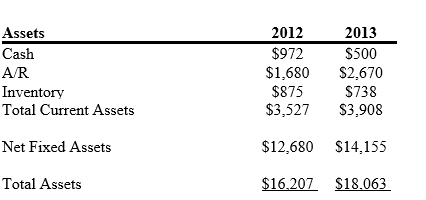

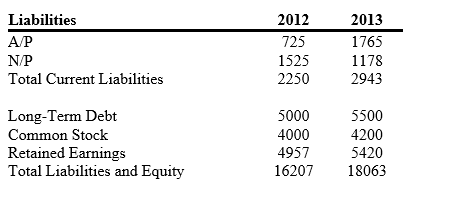

2012 and 2013 Balance Sheets (000's)

Table 4.1

Table 4.1

Bacon Signs

2013 Income Statement (000's)

11edd83c_d573_3d47_9cee_1bb868be6453_TB3691_00

Bacon Signs

2012 and 2013 Balance Sheets (000's)

11edd83d_002a_e888_9cee_61df2db7fdb0_TB3691_00

11edd83d_0ded_db89_9cee_3104334f53cf_TB3691_00

-Use the information to determine the 2013 dividend payout ratio for Bacon Signs.

A) This question cannot be answered from the information provided.

B) $250/$7418 = 0.03

C) $463/$713 = 0.65

D) $250/$713 = 0.35

Correct Answer:

Verified

Q34: A firm's age of accounts receivable:

A)measures the

Q35: _ look at a firm's ability to

Q36: How many times can the Johnson Corporation

Q37: Which of the following questions is more

Q38: Table 4.1

Bacon Signs

2013 Income Statement (000's)

Q40: To create a common-size income statement for

Q41: The asset turnover measure indicates how much

Q42: A grocery store chain with a high

Q43: Some analysts claim that the true value

Q44: ROE is an important benchmark because it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents