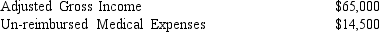

Mr.and Mrs.Sanborn are retired and have had several medical problems this year.Their financial matters for 2008 are as follows:  How much would the Sanborns' medical expenses contribute to their total itemized deductions?

How much would the Sanborns' medical expenses contribute to their total itemized deductions?

A) $ 0

B) $ 4,875

C) $ 7,500

D) $ 9,625

E) $14,500

Correct Answer:

Verified

Q93: Which of the following can be adjustment(s)to

Q102: Itemized nonbusiness expenses do not include

A)charitable contributions.

B)state

Q105: Murray (age 68,single)just sold his home of

Q106: The total amount that you owe for

Q108: For 2011,each personal exemption reduced taxable income

Q111: Mr.and Mrs.Davenport have three children ages 3,6,and

Q113: If you do not wish to itemize

Q114: Medical and dental expenses may be included

Q115: Which of the following cannot be adjustment(s)to

Q117: Tax credits reduce your

A)tax liability.

B)adjusted gross income.

C)tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents