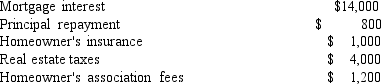

Jackie is in the 28% marginal tax bracket and has no other itemized deductions except those related to her home.If her standard deduction is $4,750 and she incurs the following costs related to housing,how much tax savings will she receive as a result of her home purchase?

A) $13,250

B) $ 5,040

C) $ 3,710

D) $ 2,800

E) none

Correct Answer:

Verified

Q102: Which of the following is not associated

Q107: The seller of the house typically pays

Q110: A fee charged by lenders as a

Q119: An escrow account is used to collect

Q126: If the maximum loan-to-value ratio that a

Q127: If you made a down payment of

Q128: The following is/are major source(s)of home mortgages:

A)

Q130: _ could be deducted on your Federal

Q133: A lender will usually require a loan-to-value

Q134: One would be more likely to pay

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents