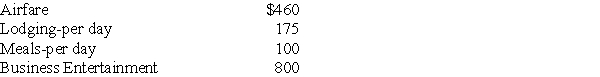

Richard traveled from New Orleans to New York for both business and vacation.He spent 4 days conducting business and some days vacationing.He incurred the following expenses:

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

a.He spends three days on vacation,in addition to the business days.

b.He spends six days on vacation,in addition to the business days.

Correct Answer:

Verified

If personal days exceed busi...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: A three- day investment conference is held

Q21: Taxpayers may use the standard mileage rate

Q22: Transportation expenses incurred to travel from one

Q23: David acquired an automobile for $30,000 for

Q24: Rui,a CPA,is employed by a firm with

Q24: What factors are considered in determining whether

Q27: Chuck, who is self- employed, is scheduled

Q27: Brittany,who is an employee,drove her automobile a

Q28: Jordan,an employee,drove his auto 20,000 miles this

Q31: Norman traveled to San Francisco for four

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents