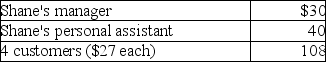

Shane,an employee,makes the following gifts,none of which are reimbursed:  What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

A) $125

B) $150

C) $75

D) $178

Correct Answer:

Verified

Q29: If an employee incurs travel expenditures and

Q37: A taxpayer goes out of town to

Q47: "Associated with" entertainment expenditures generally must occur

Q49: Joe is a self-employed tax attorney who

Q51: Dues paid to social or athletic clubs

Q53: Self-employed individuals receive a for AGI deduction

Q54: Clarissa is a very successful real estate

Q55: Generally,50% of the cost of business gifts

Q56: Pat is a sales representative for a

Q57: Austin incurs $3,600 for business meals while

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents