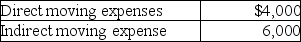

Edward incurs the following moving expenses:  The employer reimburses Edward for the full $10,000.What is the amount to be reported as income by Edward?

The employer reimburses Edward for the full $10,000.What is the amount to be reported as income by Edward?

A) $0

B) $4,000

C) $6,000

D) $10,000

Correct Answer:

Verified

Q44: A company maintains a qualified pension plan

Q45: Alex is a self-employed dentist who operates

Q46: In-home office expenses are deductible if the

Q51: Under a qualified pension plan,the employer's deduction

Q57: An employer contributing to a qualified retirement

Q75: All of the following may deduct education

Q76: Donald takes a new job and moves

Q76: Corporations issuing incentive stock options receive a

Q78: Ellie,a CPA,incurred the following deductible education expenses

Q79: Kim currently lives in Buffalo and works

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents