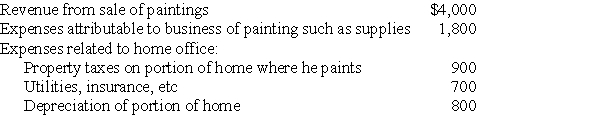

Dighi,an artist,uses a room in his home (250 square feet)as a studio exclusively to paint.The studio meets the requirements for a home office deduction.(Painting is considered his trade or business. )The following information appears in Dighi's records:

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(b)If some amount is not allowed under the tax law,how is the disallowed amount treated?

(c)Assume all of Dighi's records of expenses relating to the room were destroyed in a major paint spill.How much of a home office deduction,if any,will he be allowed?

Correct Answer:

Verified

$2,200 will be deducted in the current...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: A sole proprietor will not be allowed

Q42: In-home office expenses which are not deductible

Q48: In-home office expenses for an office used

Q52: Fin is a self-employed tutor,regularly meeting with

Q58: In a defined contribution pension plan,fixed amounts

Q59: There are several different types of qualified

Q68: Employees receiving nonqualified stock options recognize ordinary

Q72: When are home- office expenses deductible?

Q74: A sole proprietor establishes a Keogh plan.The

Q75: SIMPLE retirement plans allow a higher level

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents