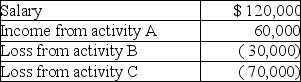

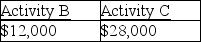

Jana reports the following income and loss:  Activities A,B,and C are all passive activities.

Activities A,B,and C are all passive activities.

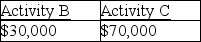

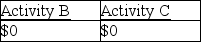

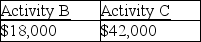

Based on this information,Jana has the following suspended losses

A)

B)

C)

D)

Correct Answer:

Verified

Q29: Taxpayers are allowed to recognize net passive

Q43: Shaunda has AGI of $90,000 and owns

Q44: Justin has AGI of $110,000 before considering

Q46: A taxpayer's rental activities will be considered

Q47: Mara owns an activity with suspended passive

Q52: Jeff owned one passive activity.Jeff sold the

Q57: Jorge owns activity X which produced a

Q59: Nancy reports the following income and loss

Q61: Which of the following is most likely

Q67: When personal-use property is covered by insurance,no

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents