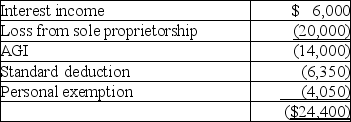

Kayla reported the following amounts in her 2017 tax return:  Kayla has generated an NOL of

Kayla has generated an NOL of

A) $0.

B) ($24,350) .

C) ($14,000) .

D) ($20,000) .

Correct Answer:

Verified

Q86: Vera has a key supplier for her

Q90: Last year,Abby loaned her friend,Pat,$10,000.Although Pat had

Q92: Which of the following expenses or losses

Q102: Due to an unusual event,a taxpayer has

Q103: In October 2017,Jonathon Remodeling Co. ,an accrual-method

Q108: An individual taxpayer has negative taxable income

Q111: A taxpayer's home is destroyed by fire,resulting

Q112: In 2016,Grace loaned her friend Paula $12,000

Q229: What are some factors which indicate that

Q235: Distinguish between the accrual- method taxpayer and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents