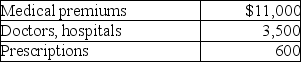

Caleb's medical expenses before reimbursement for the year include the following:  Caleb's AGI for the year is $50,000.He is single and age 58.Caleb also receives a reimbursement for medical expenses of $1,000.Caleb's deductible medical expenses that will be added to the other itemized deduction will be

Caleb's AGI for the year is $50,000.He is single and age 58.Caleb also receives a reimbursement for medical expenses of $1,000.Caleb's deductible medical expenses that will be added to the other itemized deduction will be

A) $10,350.

B) $9,100.

C) $14,100.

D) $10,100.

Correct Answer:

Verified

Q2: Medical expenses paid on behalf of an

Q6: Jeffrey,a T.V.news anchor,is concerned about the wrinkles

Q21: A review of the 2017 tax file

Q22: In 2017,Carlos filed his 2016 state income

Q24: Self-employed individuals may deduct the full self-employment

Q26: Alan,who is a security officer,is shot while

Q27: Arun paid the following taxes this year:

Q28: Matt paid the following taxes this year:

Q28: Assessments made against real estate for the

Q276: Patrick and Belinda have a twelve- year-

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents