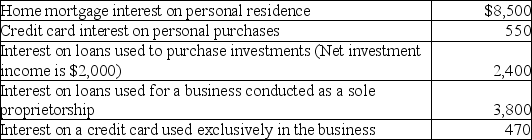

Teri pays the following interest expenses during the year:  What is the amount of interest expense that can be deducted as an itemized deduction?

What is the amount of interest expense that can be deducted as an itemized deduction?

A) $10,500

B) $10,900

C) $14,300

D) $14,700

Correct Answer:

Verified

Q36: Doug pays a county personal property tax

Q46: When both borrowed and owned funds are

Q57: Peter is assessed $630 for street improvements

Q61: Phuong has the following sources of investment

Q63: In 2016,Mario earned $9,000 in net investment

Q65: Valeria owns a home worth $1,400,000,with a

Q65: Wayne and Maria purchase a home on

Q66: Investment interest expense is deductible

A)as an offset

Q68: On July 31 of the current year,Marjorie

Q74: In the current year,Julia earns $9,000 in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents