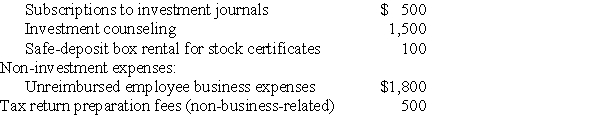

Phoebe's AGI for the current year is $120,000.Included in this AGI is $100,000 salary and $20,000 of interest income.In earning the investment income,Phoebe paid investment interest expense of $30,000.She also incurred the following expenditures subject to the 2% of AGI limitation:

Investment expenses:

What is Phoebe's investment interest expense deduction for the year?

What is Phoebe's investment interest expense deduction for the year?

Correct Answer:

Verified

Q61: Dana paid $13,000 of investment interest expense

Q64: Claudia refinances her home mortgage on June

Q73: For charitable contribution purposes,capital gain property includes

Q76: Charitable contributions made to individuals are deductible

Q80: Nina includes the following expenses in her

Q82: An accrual-basis corporation can only deduct contributions

Q89: Sharif is planning to buy a new

Q91: Corporate charitable deductions are limited to 10%

Q92: Erin's records reflect the following information: 1.Paid

Q95: Doris donated a diamond brooch recently appraised

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents