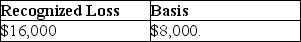

Chana purchased 400 shares of Tronco Corporation stock for $40,000 in 2014.On December 27,2017,Chana sells the 400 shares for $24,000.Chana purchases 300 shares of Tronco Corporation stock on January 16,2018 for $8,000.Chana's recognized loss on sale of the 400 shares in 2017 and her basis in her 300 new shares are

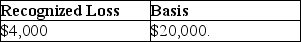

A)

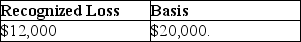

B)

C)

D)

Correct Answer:

Verified

Q84: If an activity produces a profit for

Q86: Generally,Section 267 requires that the deduction of

Q87: The term "principal place of business" includes

Q96: If property that qualifies as a taxpayer's

Q98: Expenses related to a hobby are deductible

Q101: Donald sells stock with an adjusted basis

Q114: Efrain owns 1,000 shares of RJ Inc.common

Q115: Jason sells stock with an adjusted basis

Q118: Which of the following factors is not

Q120: Bart owns 100% of the stock of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents