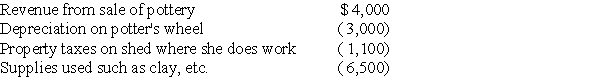

Margaret,a single taxpayer,operates a small pottery activity in her spare time.During the current year,she reported the following income and expenses from this activity which is classified as a hobby:

In addition,she had salary of $75,000 and itemized deductions,not including those listed above,of $2,200.

In addition,she had salary of $75,000 and itemized deductions,not including those listed above,of $2,200.

What is the amount of her taxable income?

Correct Answer:

Verified

Q108: The Super Bowl is played in Tasha's

Q124: Gabby owns and operates a part-time art

Q125: Anita has decided to sell a parcel

Q133: For the years 2013 through 2017 (inclusive)Max,a

Q135: Abigail's hobby is sculpting.During the current year,Abigail

Q136: For the years 2013 through 2017 (inclusive)Mary,a

Q140: Kelsey enjoys making cupcakes as a hobby

Q141: In 2017 the IRS audits a company's

Q483: During the current year, Jack personally uses

Q497: Discuss tax planning considerations which a taxpayer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents