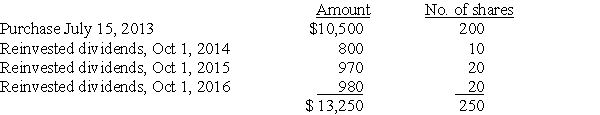

Joy purchased 200 shares of HiLo Mutual Fund on July 15,2013,for $10,500,and has been reinvesting dividends.On December 15,2017,she sells 100 shares.

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q58: Josh purchases a personal residence for $278,000

Q65: All of the following are capital assets

Q66: Mike,a dealer in securities and calendar-year taxpayer,purchased

Q70: Emma Grace acquires three machines for $80,000,which

Q71: Section 1221 of the Code includes a

Q75: Which one of the following is a

Q77: Section 1221 specifically states that inventory or

Q78: Kate subdivides land held as an investment

Q79: Normally,a security dealer reports ordinary income on

Q572: Distinguish between the Corn Products doctrine and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents