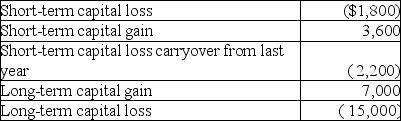

During the current year,Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

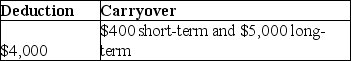

A)

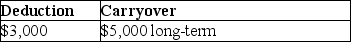

B)

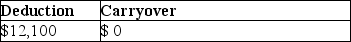

C)

D)

Correct Answer:

Verified

Q103: Tina,whose marginal tax rate is 33%,has the

Q104: Jade is a single taxpayer in the

Q105: Chen had the following capital asset transactions

Q107: Amanda,whose tax rate is 33%,has NSTCL of

Q109: Gertie has a NSTCL of $9,000 and

Q110: Corporate taxpayers may offset capital losses only

Q110: Max sold the following capital assets this

Q111: In the current year,ABC Corporation had the

Q113: Topaz Corporation had the following income and

Q118: Abra Corporation generated $100,000 of taxable income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents