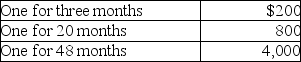

CT Computer Corporation,an accrual-basis taxpayer,sells service contracts on the computers it sells.At the beginning of January of this year,CT Corporation sold contracts with service to begin immediately:  The amount of income CT Corporation must report for this year is

The amount of income CT Corporation must report for this year is

A) $200.

B) $1,000.

C) $1,680.

D) $5,000.

Correct Answer:

Verified

Q44: Improvements to leased property made by a

Q47: One of the requirements that must be

Q48: Chance Corporation began operating a new retail

Q52: Gains realized from property transactions are included

Q52: Which of the following constitutes constructive receipt

Q53: XYZ Corporation declares a 10 percent stock

Q53: Ms.Marple's books and records for 2017 reflect

Q60: Speak Corporation,a calendar-year,accrual-basis taxpayer,sell packages of foreign

Q61: Which of the following bonds do not

Q79: Unemployment compensation is exempt from federal income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents