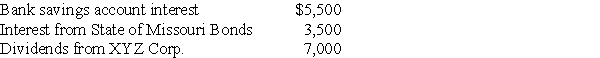

Kevin is a single person who earns $70,000 in salary for 2017 and has other income from a variety of investments,as follows:

Kevin received tax refunds when he filed his 2016 tax returns in April 2017.His federal refund was $600 and his state refund was $300.Kevin deducted his state taxes paid in 2016 as an itemized deduction on his 2016 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2017 return.

Kevin received tax refunds when he filed his 2016 tax returns in April 2017.His federal refund was $600 and his state refund was $300.Kevin deducted his state taxes paid in 2016 as an itemized deduction on his 2016 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2017 return.

Compute Kevin's taxable income for 2017.

Correct Answer:

Verified

The interest from the munici...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q111: Betty is a single retiree who receives

Q116: Sheryl is a single taxpayer with a

Q117: Insurance proceeds received because of the destruction

Q121: Ellen is a single taxpayer with qualified

Q123: Leigh inherited $65,000 of City of New

Q125: Edward is considering returning to work part-time

Q126: Under the terms of a divorce agreement

Q127: Gwen's marginal tax bracket is 25%.Gwen pays

Q129: Emma is the sole shareholder in Pacific

Q904: Billy, age 10, found an old baseball

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents