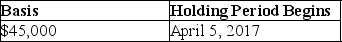

On April 4,2017,Joan contributes business equipment (she had purchased on October 23,2012) having a $45,000 FMV and a $40,000 adjusted basis to the EJK Partnership in exchange for a 25% interest in the capital and profits.The basis of the property and the date the holding period begins for the partnership is

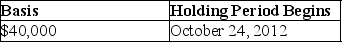

A)

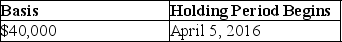

B)

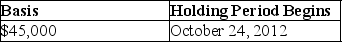

C)

D)

Correct Answer:

Verified

Q44: On July 1,Alexandra contributes business equipment (which

Q47: Hal transferred land having a $160,000 FMV

Q49: Lance transferred land having a $180,000 FMV

Q53: Patrick acquired a 50% interest in a

Q53: In 2017,Phuong transferred land having a $150,000

Q54: Scott provides accounting services worth $40,000 to

Q57: Kuda exchanges property with a FMV of

Q57: Edith contributes land having $100,000 FMV and

Q67: Martha transferred property with a FMV of

Q75: George transferred land having a $170,000 FMV

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents