Atiqa receives a nonliquidating distribution of land from her partnership.The partnership purchased the land five years ago for $20,000.At the time of the distribution,it is worth $28,000.Prior to the distribution,Atiqa's basis in her partnership interest is $37,000.Due to the distribution Atiqa and the partnership will recognize income of

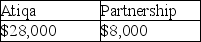

A)

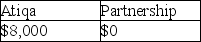

B)

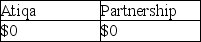

C)

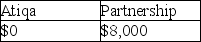

D)

Correct Answer:

Verified

Q63: All of the following are separately stated

Q64: Which of the following will be separately

Q72: Sandy and Larry each have a 50%

Q73: At the beginning of this year,Edmond and

Q74: David and Joycelyn form an equal partnership

Q78: Mia is a 50% partner in a

Q81: All of the following statements are true

Q85: Ben is a 30% partner in a

Q89: Jamahl has a 65% interest in a

Q97: Jamahl has a 65% interest in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents