Stephanie owns a 25% interest in a qualifying S corporation.Stephanie's basis in the stock was $40,000 at the beginning of the year.Stephanie made no capital contributions and received no distributions during the year.Stephanie loaned the S corporation $10,000 this year.The S corporation incurred a $240,000 ordinary loss this year.Stephanie's deduction and carryover of the unused loss are

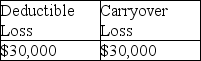

A)

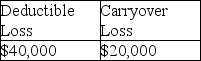

B)

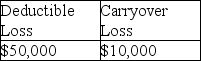

C)

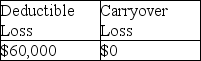

D)

Correct Answer:

Verified

Q112: All of the following are requirements to

Q122: New business owners expecting losses in the

Q131: Which of the following statements regarding voluntary

Q135: Worthy Corporation elected to be taxed as

Q138: Bryan Corporation,an S corporation since its organization,is

Q141: Dori and Matt will be equal owners

Q143: Realto LLC is a tax partnership which

Q144: Which of the following statements is correct,assuming

Q1264: Discuss whether a C corporation, a partnership,

Q1278: Minna is a 50% owner of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents