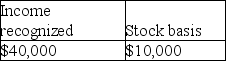

Tony is the 100% shareholder of a corporation established five years ago.It has always been an S corporation.After adjustment for this year's corporate income,but before taking distributions into account,Tony has a $50,000 stock basis.The corporation pays Tony a $40,000 cash distribution.As a result of this distribution,Tony will have an ending stock basis and recognized income of

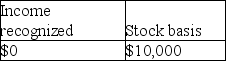

A)

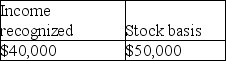

B)

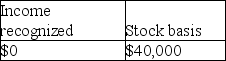

C)

D)

Correct Answer:

Verified

Q112: All of the following are requirements to

Q121: Raina owns 100% of Tribo Inc.,an S

Q126: Stephanie owns a 25% interest in a

Q128: Empire Corporation has operated as a C

Q131: Which of the following statements regarding voluntary

Q135: Worthy Corporation elected to be taxed as

Q137: On January 1 of this year (assume

Q138: Bryan Corporation,an S corporation since its organization,is

Q140: An S corporation distributes land with a

Q1278: Minna is a 50% owner of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents