Tonya is the 100% shareholder of a corporation established five years ago.It has always been an S corporation.After adjustment for this year's corporate income,but before taking distributions into account,Tonya has a $50,000 stock basis.The corporation pays Tonya a $60,000 cash distribution.As a result of this distribution,Tonya will have an ending stock basis and recognized income of

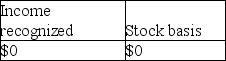

A)

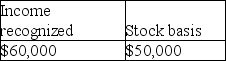

B)

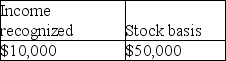

C)

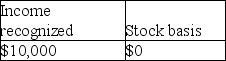

D)

Correct Answer:

Verified

Q101: An S corporation recognizes gain or loss

Q107: Which of the following characteristics can disqualify

Q108: Passive activity loss limitations apply to S

Q109: An S corporation may not have more

Q121: For each of the following independent cases

Q123: A new corporation is formed on January

Q123: An S corporation distributes land to its

Q124: S corporation shareholders who own more than

Q133: All of the following would reduce the

Q1235: Discuss the concept of partnership guaranteed payments.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents