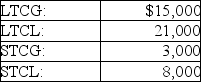

A corporation has the following capital gains and losses during the current year:  The tax result to the corporation is

The tax result to the corporation is

A) deduct $3,000 of the STCL currently; carry forward the remaining $2,000 STCL and $6,000 LTCL.

B) deduct $5,000 STCL and $6,000 LTCL.

C) deduct nothing currently; carry back the $5,000 STCL and $6,000 LTCL for three years and carry forward for 5 years,if necessary.

D) deduct nothing currently; carry back the $11,000 STCL for three years and carry forward for 5 years,if necessary.

Correct Answer:

Verified

Q23: If a corporation's charitable contributions exceed the

Q25: Montage Corporation has the following income and

Q25: Unused charitable contributions of a corporation are

Q26: A corporation which makes a charitable contribution

Q27: Witte Corporation reported the following results for

Q32: Various members of Congress favor a reduction

Q33: A corporation has the following capital gains

Q34: With respect to charitable contributions by corporations,all

Q34: For this tax year,Madison Corporation had taxable

Q53: Charades Corporation is a publicly held company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents