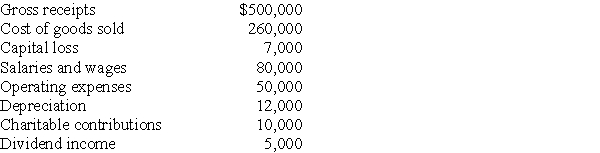

Sycamore Corporation's financial statements show the following items for the current year in its financial accounting records:

For tax purposes,depreciation is $22,000.Sycamore owns less than 20% of the company from which it received dividends.Calculate Sycamore's taxable income,tax liability,and carryforwards.

For tax purposes,depreciation is $22,000.Sycamore owns less than 20% of the company from which it received dividends.Calculate Sycamore's taxable income,tax liability,and carryforwards.

Correct Answer:

Verified

No deduction is allowed for the capita...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: In a parent-subsidiary controlled group,the common parent

Q50: For purposes of the accumulated earnings tax,reasonable

Q55: Corporations that are members of a parent-subsidiary

Q64: When computing a corporation's alternative minimum taxable

Q65: Mason Corporation is a personal service corporation

Q67: Bartlett Corporation,a U.S.manufacturer,reports the following results in

Q70: Major Corporation's taxable income for the current

Q71: The corporate tax return has been prepared

Q72: A corporation has regular taxable income of

Q73: Ohio Corporation's taxable income for the current

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents