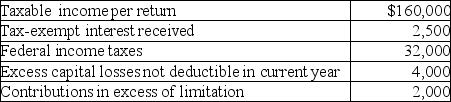

Greg Corporation,an accrual method taxpayer,had accumulated earnings and profits of $300,000 as of December 31 last year.For its current tax year,Greg's books and records reflect the following:  Based on the above,what is the amount of Greg Corporation's current earnings and profits for this year?

Based on the above,what is the amount of Greg Corporation's current earnings and profits for this year?

A) $120,500

B) $122,000

C) $124,500

D) $129,500

Correct Answer:

Verified

Q26: Dixie Corporation distributes $31,000 to its sole

Q82: A calendar-year corporation has a $75,000 current

Q87: A corporation earns $500,000 of current E&P

Q89: Tara transfers land with a $600,000 adjusted

Q91: If a corporation has no E&P,a distribution

Q99: A calendar-year corporation has a $15,000 current

Q100: Danielle transfers land with a $100,000 FMV

Q114: Janice transfers land and a building with

Q116: Individuals Jimmy and Ellen form JE Corporation.Ellen

Q1369: Chi transfers assets with a $150,000 FMV

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents