A corporation distributes land worth $200,000 to its sole shareholder.The corporation had purchased the land several years ago for $120,000.The corporation has over $1 million of E&P.How much income will the corporation and the shareholder recognize?

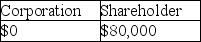

A)

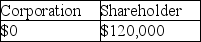

B)

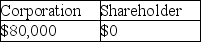

C)

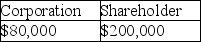

D)

Correct Answer:

Verified

Q94: Blue Corporation distributes land and building having

Q96: A corporation redeems 10 percent of the

Q98: If a corporation distributes appreciated property to

Q101: Corkie Corporation distributes $80,000 cash along with

Q107: A corporation distributes land with a FMV

Q108: How does the treatment of a liquidation

Q115: A corporation is owned 70% by Jones

Q131: Pursuant to a complete liquidation,Southern Electric Corporation

Q132: Tester Corporation acquired all of the stock

Q1392: What factors are considered in determining whether

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents