Ten years ago Finn Corporation formed a new 100 percent owned subsidiary,Wing Corporation,with a $500,000 investment.Wing Corporation is completely liquidated this year,with all assets distributed to Finn Corporation.As of the liquidation date,Wing has a basis in its assets of $350,000,and the assets are valued at $550,000.What is the gain or loss recognized by Finn Corporation due to the liquidating distribution,and what is Finn Corporation's basis in the assets received from Wing Corporation?

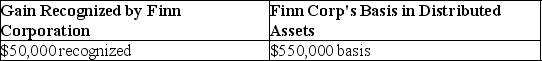

A)

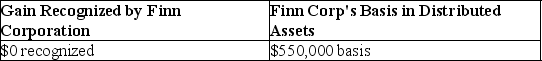

B)

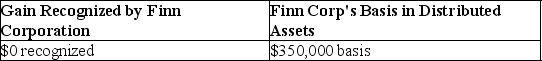

C)

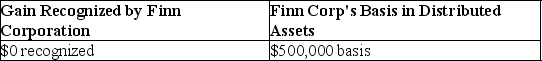

D)

Correct Answer:

Verified

Q113: A shareholder receives a distribution from a

Q116: A corporation is owned 70% by Jones

Q119: Total Corporation has earned $75,000 current E&P

Q120: A corporation is owned 70% by Jones

Q123: Lafayette Corporation distributes $80,000 in cash along

Q125: Star Corporation,in complete liquidation,makes distributions to its

Q126: Whaler Corporation makes a liquidating distribution of

Q127: Topper Corporation makes a liquidating distribution of

Q1365: Additional capital may be obtained by a

Q1394: Discuss the tax consequences of a complete

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents