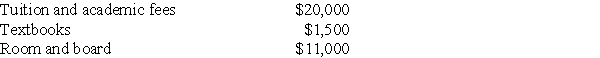

Burton and Kay are married,file a joint return with an AGI of $116,000,and have one dependent child,Tyler,who is a full-time student in a Master of Accountancy program.The following expenses relate to his costs of attendance in 2017:

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Sam and Megan are married with two

Q105: The general business credit may not exceed

Q105: In 2017,Rita is divorced with one child.She

Q107: A taxpayer will be ineligible for the

Q108: Tyler and Molly,who are married filing jointly

Q108: Individuals without children are eligible for the

Q111: Which of the following expenditures will qualify

Q113: Indie Corporation purchases a building for use

Q114: Tyne is single and has AGI of

Q119: Layla earned $20,000 of general business credits

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents