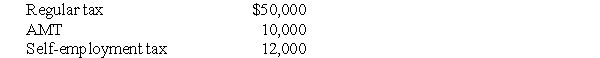

Beth and Jay project the following taxes for the current year:

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a.Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b.Preceding tax year-AGI of $155,000 and total taxes of $48,000.

Correct Answer:

Verified

a.The taxpayers should pay i...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: If an employee has more than one

Q112: If estimated tax payments equal or exceed

Q123: Amelida expects to earn $145,000 of AGI

Q125: Ivan has generated the following taxes and

Q127: Bob's income can vary widely from year-to-year

Q130: If a taxpayer's AGI is greater than

Q132: Hawaii,Inc. ,began a child care facility for

Q134: Individuals who do not have minimum essential

Q1657: Discuss tax- planning options available for expenses

Q1659: Describe the differences between the American Opportunity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents