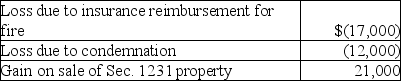

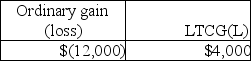

This year Jenna had the gains and losses noted below on property,plant and equipment used in her business.Each asset had been held longer than one year.Jenna has not previously disposed of any business assets.  Jenna will recognize

Jenna will recognize

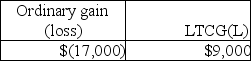

A)

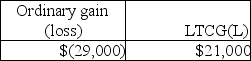

B)

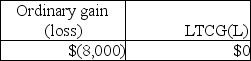

C)

D)

Correct Answer:

Verified

Q28: Gain due to depreciation recapture is included

Q31: For a business,Sec.1231 property does not include

A)timber,coal,or

Q37: Harry owns equipment ($50,000 basis and $38,000

Q41: The following are gains and losses recognized

Q42: Sec.1245 can increase the amount of gain

Q44: This year Pranav had the gains and

Q45: Terry has sold equipment used in her

Q47: A taxpayer has a gain on Sec.1245

Q57: If a taxpayer has gains on Sec.1231

Q1702: Sarah owned land with a FMV of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents