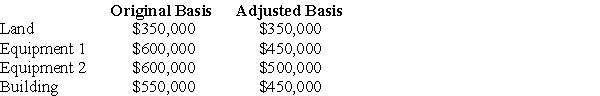

Describe the tax treatment for a noncorporate taxpayer in the 39.6% marginal tax bracket who sells each of the first two assets for $500,000 and each of the second two assets for $750,000.Each asset was purchased in 2013 and is used in a trade or business.There are no other gains and losses and no nonrecaptured Sec.1231 losses.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: When appreciated property is transferred at death,the

Q68: When a donee disposes of appreciated gift

Q77: Gifts of appreciated depreciable property may trigger

Q84: Douglas bought office furniture two years and

Q85: A taxpayer purchased a factory building in

Q90: Echo Corporation plans to sell a small

Q91: Clarise bought a building three years ago

Q93: If no gain is recognized in a

Q97: Pam owns a building used in her

Q98: Octet Corporation placed a small storage building

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents