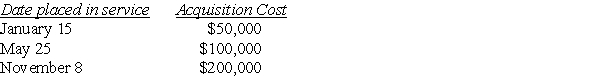

Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property in 2017 and does not use Sec.179.The property does not qualify for bonus depreciation.Mehmet places the property in service on the following schedule:

What is the total depreciation for 2016?

What is the total depreciation for 2016?

Correct Answer:

Verified

More than 40% of the assets ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Atiqa took out of service and sold

Q58: Paul bought a computer for $15,000 for

Q59: On November 3rd of this year,Kerry acquired

Q61: Greta,a calendar-year taxpayer,acquires 5-year tangible personal property

Q62: Everest Corp.acquires a machine (seven-year property)on January

Q64: In the current year George,a college professor,acquired

Q65: Enrico is a self-employed electrician.In May of

Q66: On June 30,2017,Temika purchased office furniture (7-year

Q67: On May 1,2008,Empire Properties Corp. ,a calendar-year

Q68: In January of 2017,Brett purchased a Porsche

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents