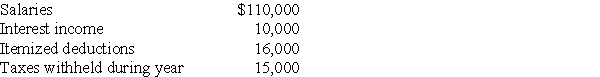

Brad and Angie had the following income and deductions during 2017:

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Correct Answer:

Verified

Tax = $10,452.50 + .25(95,90...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: Organizing a corporation as an S Corporation

Q60: Kole earns $140,000 in 2017 in his

Q60: In a limited liability partnership,a partner is

Q64: Chris,a single taxpayer,had the following income and

Q68: In an S corporation,shareholders

A)are taxed on their

Q69: Rocky and Charlie form RC Partnership as

Q72: Fireball Corporation is an S corporation.Leyla owns

Q73: Limited liability companies may elect to be

Q75: Limited liability company members (owners)are responsible for

Q2216: During the current tax year, Frank Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents