Alto and Bass Corporations have filed consolidated tax returns for several calendar years.At the close of business on September 30,Alto Corporation sells all of the Bass Corporation stock.What portion of Alto's and Bass's income for the current year will be included in the consolidated return,assuming its income is earned evenly throughout the year and all months have 30 days?

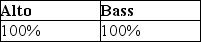

A)

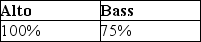

B)

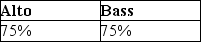

C)

D) none of the above

Correct Answer:

Verified

Q5: Cardinal and Bluebird Corporations both use a

Q7: Cardinal and Bluebird Corporations both use a

Q10: Jeffrey Corporation owns 85% of Placer Corporation

Q17: Diana Corporation owns stock of Tomika Corporation.For

Q24: Subsidiary Corporation purchases a used machine from

Q26: Parent Corporation sells land (a capital asset)to

Q28: Which of the following events is an

Q29: Identify which of the following statements is

Q31: Parent Corporation sells land (a capital asset)to

Q36: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents