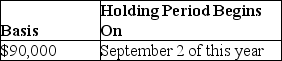

Ajax and Brindel Corporations have filed consolidated returns for several calendar years.Ajax acquires land for $60,000 on January 1 of last year.On September 1 of this year,Ajax sells the land to Brindel for $90,000.The basis and holding period for the land acquired by Brindel are:

A)

B)

C)

D) none of the above

Correct Answer:

Verified

Q21: Identify which of the following statements is

Q22: Parent and Subsidiary Corporations have filed calendar-year

Q36: Apple Corporation and Banana Corporation file consolidated

Q37: Which of the following events is an

Q39: Penish and Sagen Corporations have filed consolidated

Q43: Steps 1 through 3 result in the

Q44: Identify which of the following statements is

Q45: Compute each group member's taxable income (or

Q56: Parent Corporation purchases a machine (a five-year

Q58: Which of the following statements is true?

A)A

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents