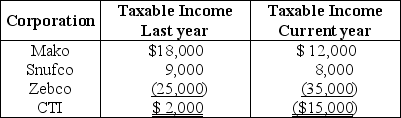

Mako and Snufco Corporations are affiliated and have filed consolidated returns for the past three years.Mako acquired 100% of Zebco stock on January 1 of last year,the date of Zebco's formation.Mako,Snufco,and Zebco,who have filed consolidated returns for last year and the current year,report the following taxable incomes.  The $15,000 consolidated NOL reported in the current year

The $15,000 consolidated NOL reported in the current year

A) cannot be carried back.

B) can be carried back three years ago only.

C) can be carried back to last year and the remainder,if any,carried forward to subsequent years.

D) can only be used in future years.

Correct Answer:

Verified

Q75: What is the consequence of having losses

Q82: All of the stock of Hartz and

Q85: Parent and Subsidiary Corporations form an affiliated

Q86: Last year,Trix Corporation acquired 100% of Track

Q87: On January 1,Alpha Corporation purchases 100% of

Q88: What is the carryback and carryforward rule

Q91: Key and Glass Corporations were organized last

Q92: A consolidated NOL carryover is $52,000 at

Q93: Identify which of the following statements is

Q94: Pants and Skirt Corporations are affiliated and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents