Broom Corporation transfers assets with an adjusted basis of $300,000 and an FMV of $400,000 to Docker Corporation in exchange for $400,000 of Docker Corporation stock as part of a tax-free reorganization.The Docker stock had been purchased from its shareholders one year earlier for $350,000.How much gain do Broom and Docker Corporations recognize on the asset transfer?

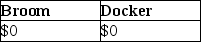

A)

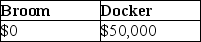

B)

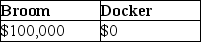

C)

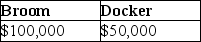

D)

Correct Answer:

Verified

Q22: Rocky is a party to a tax-free

Q23: Identify which of the following statements is

Q24: What are the two steps of a

Q24: Bob exchanges 4,000 shares of Beetle Corporation

Q27: In a nontaxable reorganization, shareholders of the

Q33: Acquiring Corporation acquires all of the assets

Q34: Identify which of the following statements is

Q37: The acquiring corporation does not recognize gain

Q39: Identify which of the following statements is

Q40: In a Sec. 338 election, the target

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents