Under a plan of complete liquidation,Key Corporation distributes land (not a disqualified property) with an adjusted basis of $410,000 and an FMV of $300,000 for all Sharon's stock.Sharon's basis in her 5% interest in the Key stock is $250,000.Find Sharon's basis in the land and Key Corporation's recognized gain or loss.

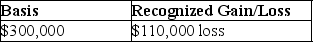

A)

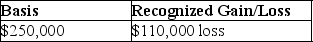

B)

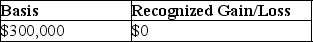

C)

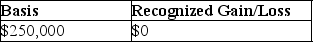

D)

Correct Answer:

Verified

Q25: Identify which of the following statements is

Q26: How is the gain/loss calculated if a

Q27: Dexer Corporation is owned 70% by Amy

Q28: John and June, husband and wife, have

Q31: The stock of Cooper Corporation is 70%

Q36: Charlene and Dennis each own 50% of

Q37: Jack Corporation is owned 75% by Sherri

Q38: Under a plan of complete liquidation, Coast

Q39: Under the general liquidation rules, Missouri Corporation

Q40: Barnett Corporation owns an office building that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents