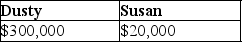

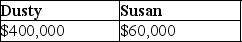

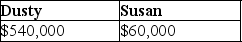

Dusty Corporation owns 90% of Palace Corporation's stock and Susan owns the remaining stock.Dusty Corporation's stock basis is $300,000 and Susan's stock basis is $20,000.Under a plan of complete liquidation,Dusty Corporation receives property with a $400,000 adjusted basis and a $540,000 FMV and Susan receives property with a $20,000 adjusted basis and a $60,000 FMV.The bases of the properties are:

A)

B)

C)

D)

Correct Answer:

Verified

Q48: Identify which of the following statements is

Q53: Identify which of the following statements is

Q59: Market Corporation owns 100% of Subsidiary Corporation's

Q65: Parent Corporation owns 100% of the stock

Q66: What attributes of a controlled subsidiary corporation

Q69: Prime Corporation liquidates its 85%-owned subsidiary Bass

Q71: What are the differences, if any, in

Q76: Ball Corporation owns 80% of Net Corporation's

Q79: Parent Corporation owns 80% of the stock

Q79: Sandy,a cash method of accounting taxpayer,has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents