Homewood Corporation adopts a plan of liquidation on June 15 and shortly thereafter sells a parcel of land on which it realizes a $50,000 gain (excluding the effects of a $5,000 sales commission) .Homewood pays its legal counsel $2,000 to draft the plan of liquidation.The accountant fees for the liquidation are $1,000,which are also paid during the year.What is Homewood Corporation's realized gain on the sale of land and deductible liquidation expenses?

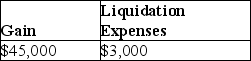

A)

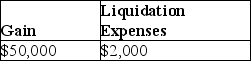

B)

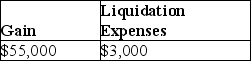

C)

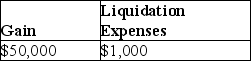

D)

Correct Answer:

Verified

Q53: Identify which of the following statements is

Q63: The general rule for tax attributes of

Q65: Parent Corporation owns 100% of the stock

Q76: Ball Corporation owns 80% of Net Corporation's

Q79: Sandy,a cash method of accounting taxpayer,has a

Q83: What is the IRS's position regarding whether

Q84: For that following set of facts,what are

Q86: Santa Fe Corporation adopts a plan of

Q86: Identify which of the following statements is

Q97: What are the tax consequences of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents