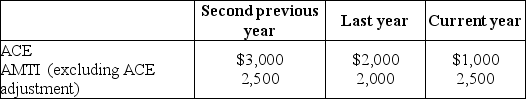

Drury Corporation,which was organized three years ago,reports the following adjusted current earnings (ACE)and preadjustment alternative minimum taxable income (AMTI)amounts.

What is the ACE adjustment to increase (or decrease)taxable income to arrive at AMTI for the second previous year?

What is the ACE adjustment to increase (or decrease)taxable income to arrive at AMTI for the second previous year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Barker Corporation,a personal service company,has $200,000 of

Q24: Identify which of the following statements is

Q25: Drury Corporation,which was organized three years ago,reports

Q26: Mountaineer,Inc.has the following results: Q27: Identify which of the following statements is Q29: Becky places five-year property in service during Q30: Identify which of the following statements is Q31: Arnold Corporation reports taxable income of $250,000,tax Q32: Certain adjustments must be made to alternative Q33: Identify which of the following statements is![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents