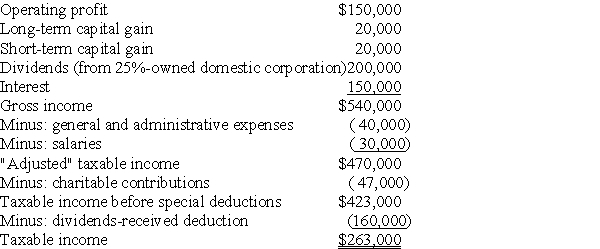

Mullins Corporation is classified as a PHC for the current year,reporting $263,000 of taxable income on its federal income tax return:

Actual charitable contributions made by Mullins Corporation were $75,000.What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Actual charitable contributions made by Mullins Corporation were $75,000.What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: Define personal holding company income.

Q35: To avoid the accumulated earnings tax, a

Q45: Eight individuals own Navy Corporation, a C

Q52: Identify which of the following statements is

Q56: A manufacturing corporation has accumulated E&P of

Q76: Eagle Corporation,a personal holding company,has the following

Q77: Smartmoney,Inc.was formed by three wealthy dentists to

Q79: Lake Corporation is a personal holding company.Lake

Q81: Green Corporation,a closely held operating corporation,reports the

Q84: Given the following information about Jones Corporation,what

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents