Beta Corporation incurs an $80,000 regular tax liability and a $20,000 AMT liability.Assuming no restrictions on Beta's ability to use the minimum tax credit,what journal entry would be necessary to record tax expense?

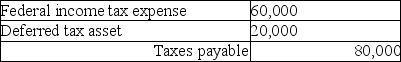

A)

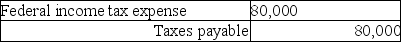

B)

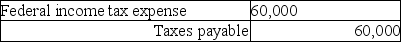

C)

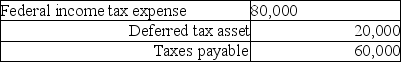

D)

Correct Answer:

Verified

Q38: Identify which of the following statements is

Q41: Which of the following is not permitted

Q42: The courts and the Treasury Regulations have

Q51: When using the Bardahl formula, an increase

Q53: Identify which of the following statements is

Q55: Identify which of the following statements is

Q58: When computing the accumulated earnings tax, which

Q94: The following information is reported by Acme

Q97: Lawrence Corporation reports the following results during

Q102: ASC 740 requires that

A)the AMT is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents