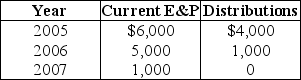

Poppy Corporation was formed three years ago.Poppy's E&P history is as follows:  Poppy Corporation's accumulated E&P on January 1 will be

Poppy Corporation's accumulated E&P on January 1 will be

A) $0.

B) $7,000.

C) $5,000.

D) $12,000.

Correct Answer:

Verified

Q3: Identify which of the following statements is

Q6: For purposes of determining current E&P, which

Q8: Current E&P does not include

A)tax-exempt interest income.

B)life

Q11: Grant Corporation sells land (a noninventory item)with

Q14: Omega Corporation is formed in 2006.Its current

Q19: Boxer Corporation buys equipment in January of

Q21: Splash Corporation has $50,000 of taxable income

Q22: Peach Corporation was formed four years ago.Its

Q24: Green Corporation is a calendar-year taxpayer.All of

Q33: A shareholder's basis in property distributed as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents