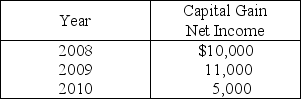

Evans Corporation has a $15,000 net capital loss in 2011.The corporation reported the following capital gain net income during the past three years.Identify which of the following statements is true.

A) The loss is used to offset the gains from 2010 and then carried back to offset $10,000 of the gains in 2008.

B) The loss is used to offset the $11,000 of the 2009 gains and then carried back to offset $4,000 of the year 2008 net gain.

C) The loss is used to offset $3,000 of the current year ordinary income,all of the year 2008 capital gains,and $7,000 of the year 2009 net gain.

D) The loss is used to offset the year 2008 net gains,then $5,000 of the year 2009 net gains.

Correct Answer:

Verified

Q22: Blueboy Inc. contributes inventory to a qualified

Q27: Garth Corporation donates inventory having an adjusted

Q29: Richards Corporation has taxable income of $280,000

Q32: Island Corporation has the following income and

Q33: In 2011,Summer Corporation earns domestic gross receipts

Q34: JLA is a U.S.shoe manufacturer.Its domestic production

Q39: In February of the current year, Brent

Q39: For purposes of the production activities deduction,domestic

Q40: Identify which of the following statements is

Q47: Walter, who owns all of the Ajax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents