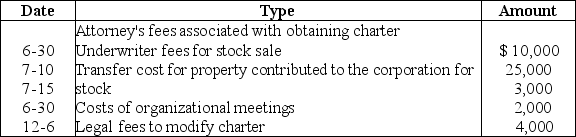

Edison Corporation is organized on July 31.The corporation starts business on August 10.The corporation adopts a November 30 fiscal year end.The following expenses are incurred during the year:  What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending November 30?

What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending November 30?

A) $16,000

B) $12,000

C) $5,156

D) $800

Correct Answer:

Verified

Q22: Blueboy Inc. contributes inventory to a qualified

Q23: Green Corporation is incorporated on March 1

Q28: The U.S.production activities deduction is based on

Q31: Identify which of the following statements is

Q32: Identify which of the following statements is

Q32: Island Corporation has the following income and

Q34: Organizational expenditures include all of the following

Q35: Booth Corporation sells a building classified as

Q36: Super Corporation gives a painting to a

Q37: If a corporation's charitable contributions exceed the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents