Yenhung,who is single,forms a corporation using a tax-free asset transfer,which qualifies under Sec.351.She contributes property having an adjusted basis of $50,000 and an FMV of $40,000.The stock received from the corporation is Sec.1244 stock.When Yenhung sells the stock for $30,000,her loss is

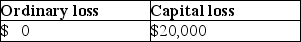

A)

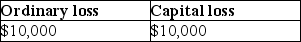

B)

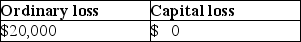

C)

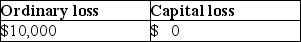

D)

Correct Answer:

Verified

Q101: Stu Walker has owned all 200 shares

Q105: Ra Corporation issues a twenty-year obligation at

Q106: Sarah has advanced money to her corporation.

Q108: Ralph and Yolanda purchased 20% of the

Q111: The City of Portland gives Data Corporation

Q113: Will, a shareholder in Wiley Corporation, lent

Q115: On April 2 of the current year,

Q121: Discuss the IRS reporting requirements under Sec.

Q122: Discuss the tax planning opportunities that are

Q123: Several years ago, John acquired 200 shares

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents